For transparency, we’ve posted here (with minimal editing) our end of the year updates, sent to the shareholders of each publication.

Overall, the group had a very strong year, doubling revenues over 2020 and passing $10 million in run rate. Not only that, but we turned a small, but nice profit. After the last damn decade (to say nothing of the last year) that feels like a big deal, and we can congratulate the whole team on reaching a big milestone. Maintaining it is the next thing, of course, but just knowing it’s possible in this business makes a big difference, giving us all renewed vigor to keep pushing in this direction.

Getting into detail on what happened, of course, the picture gets more complicated. Not everything went to plan, in both good and bad ways: some strategies worked better than expected, while in others we lagged behind our expectations.

Daily Dot

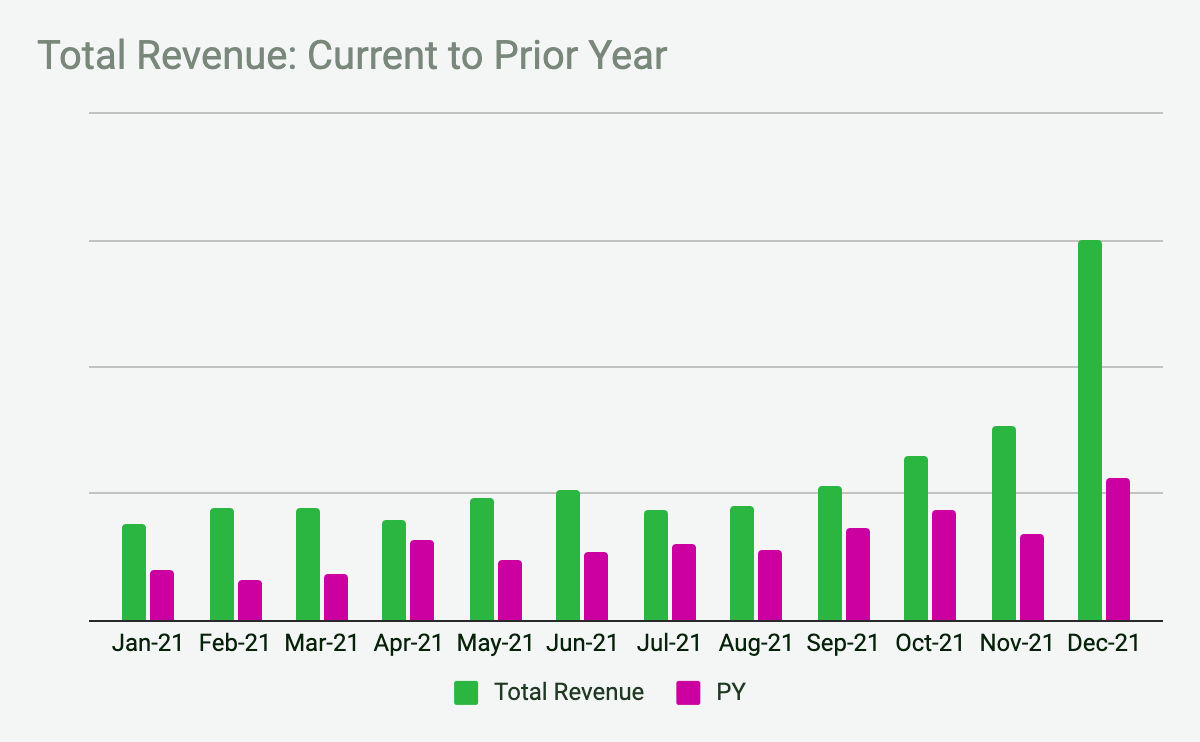

The Daily Dot was profitable every month this year and turned a small loss (low six figures) in 2020 into a significant gain (low seven figures).

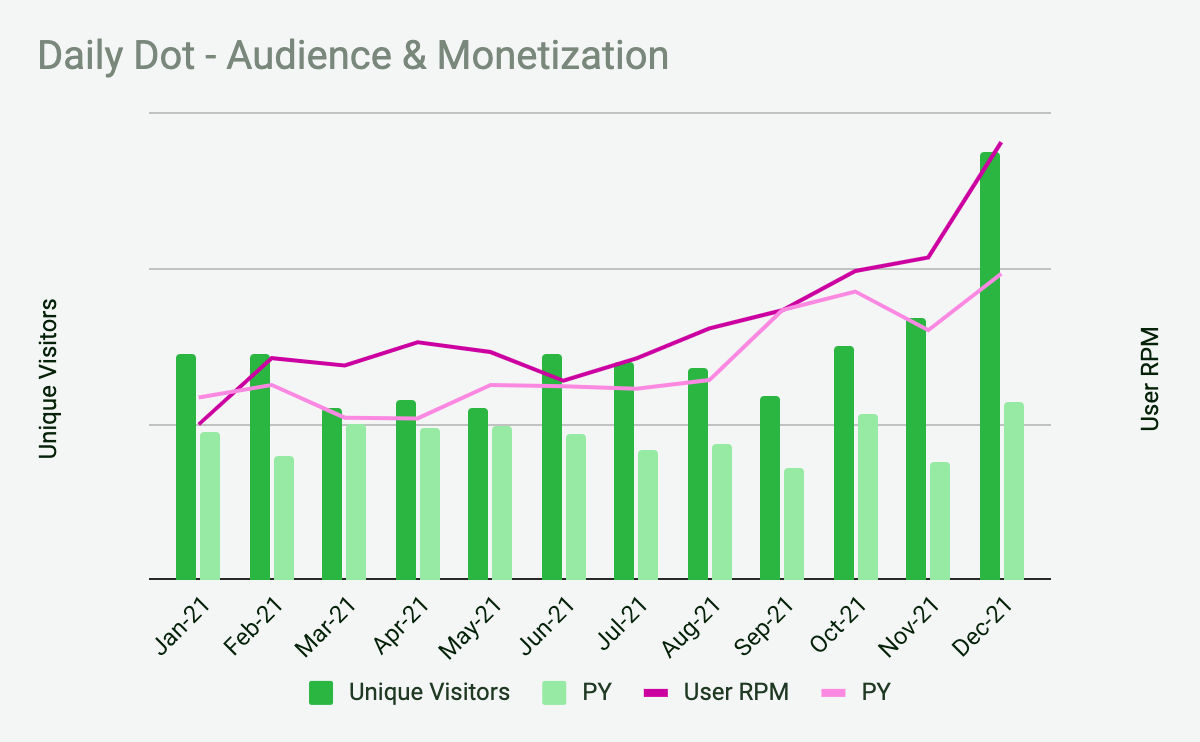

Daily Dot’s growth was primarily driven by growing traffic and programmatic revenue — both a result of our investments in technology and sales. Obviously, this is something we’ve been working on intentionally, but at least in December, our strategies worked even better than we’d hoped.

As you can see from the chart, platform improvements and new editorial strategies were pushing results slightly upward through the middle of the year, but really started to gain traction in Q4. Then traffic spiked in December, reaching a new all-time record.

Obviously, traffic will ebb and flow, and we certainly don’t expect every month to be like December. On the one hand, we are learning from this and doubling down on what works — perhaps we won’t be able to fully repeat December, but the gains of October and November represent substantial growth. On the other, we’re presuming that the full measure of traffic in December is an unrepeatable phenomenon and are making hay while the sun shines — but getting next season’s crops planted at the same time.

So, while we are trying to take the moment in stride (gratefully), we are also sticking to our plans to build the member model at Daily Dot. We have removed some of the sources of instability that have plagued us in the past, but certainly not all — we are still far too dependent on Facebook and Google for traffic, and the advertising business model in general remains an area of concern for me.

Our proposed antidote, as previously identified, is the paid member model. We haven’t launched a paid membership yet, but the first step of doing so, we believe, is building up the newsletter. Email is a direct relationship, unmediated by a middleman like Facebook or Google, and it is ultimately the most important channel for selling memberships. In the meantime, ad rates in email are the highest and most reliable, so while that’s still advertising revenue, it’s a better version. Their biggest issue is they must be direct sold; there is no (viable) programmatic option. So we need to reach critical mass before we can turn on that revenue stream.

We have made substantial progress in that area as well, and our engaged audience which was in the range of 25,000 this time last year now stands at almost 130,000. We have more work to do, but if we can continue to improve engagement and grow overall, we expect critical mass in ad sales to be reached somewhere around 300,000.

Nautilus

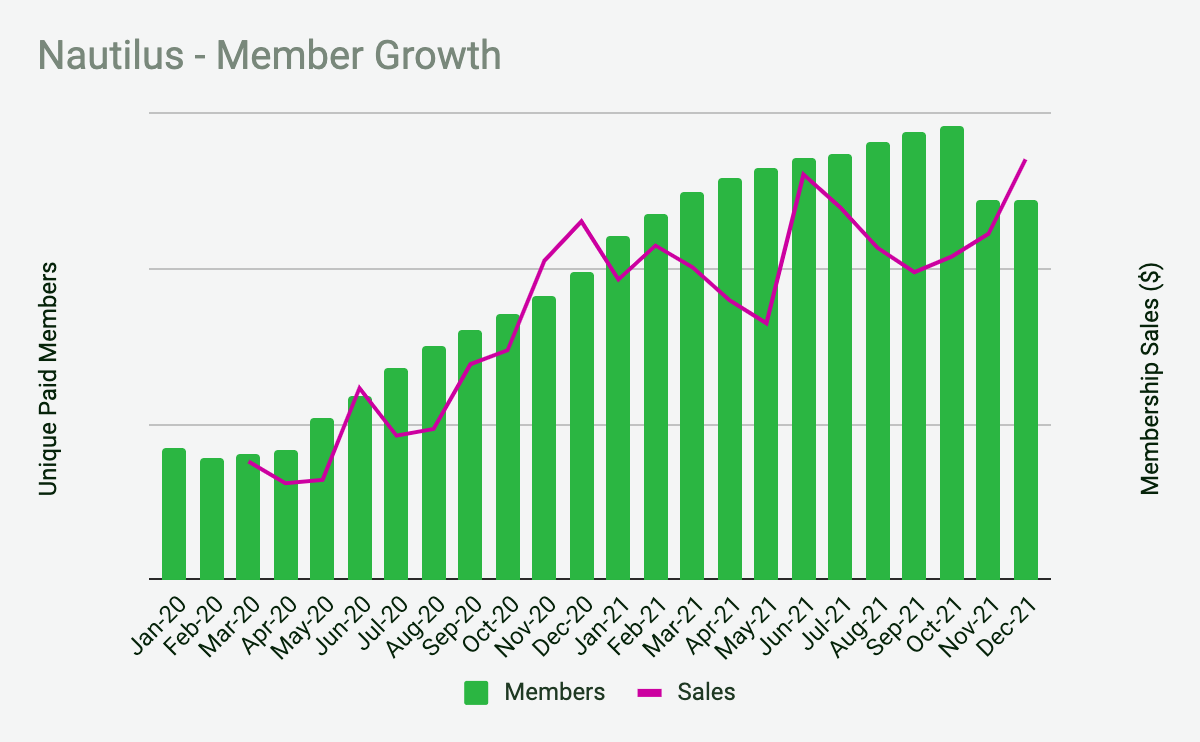

Nautilus is at the other end of the spectrum. Nautilus is where we have an already strong paid membership model, but not nearly the scale of overall traffic. Where last year Nautilus was the big driver of growth, this year Nautilus total membership has grown only about 25% over the year.

As a result, while Nautilus is very close to cash flow positive in some months, it is still running at a very small annual loss.

As shown above, through most of the year, Nautilus was on track for substantial growth — roughly tripling our unique members since we actively started marketing about 18 months before. Given that we’ve also more than doubled ARPU in that time, that means an increase of more than 6X in that period.

However, new consumer privacy rules began to seriously affect us in mid-summer and fall of this year which made the targeting tactics we were using no longer possible, slowing growth in the back half of the year. We held on to most of our gains in total membership, but had to start testing new growth strategies, and build up again. We have overall made progress, roughly doubling our email audience at Nautilus over the year.

Perhaps more importantly, our existing members continue to be very happy — average monthly churn was 4.1%, which is 64% better than the average for digital consumer media.

Overall, and despite the ongoing pandammit, the company still grew strongly overall — and reached that ever elusive goal, “profitability”. Given our goals and strategy, of course, at the beginning of the new year our primary focus is to get paid membership growth back to where it was for the first half of 2021. Nevertheless, doubling year over year after increasing 50% in 2020 is a result I think we can be pretty happy with.