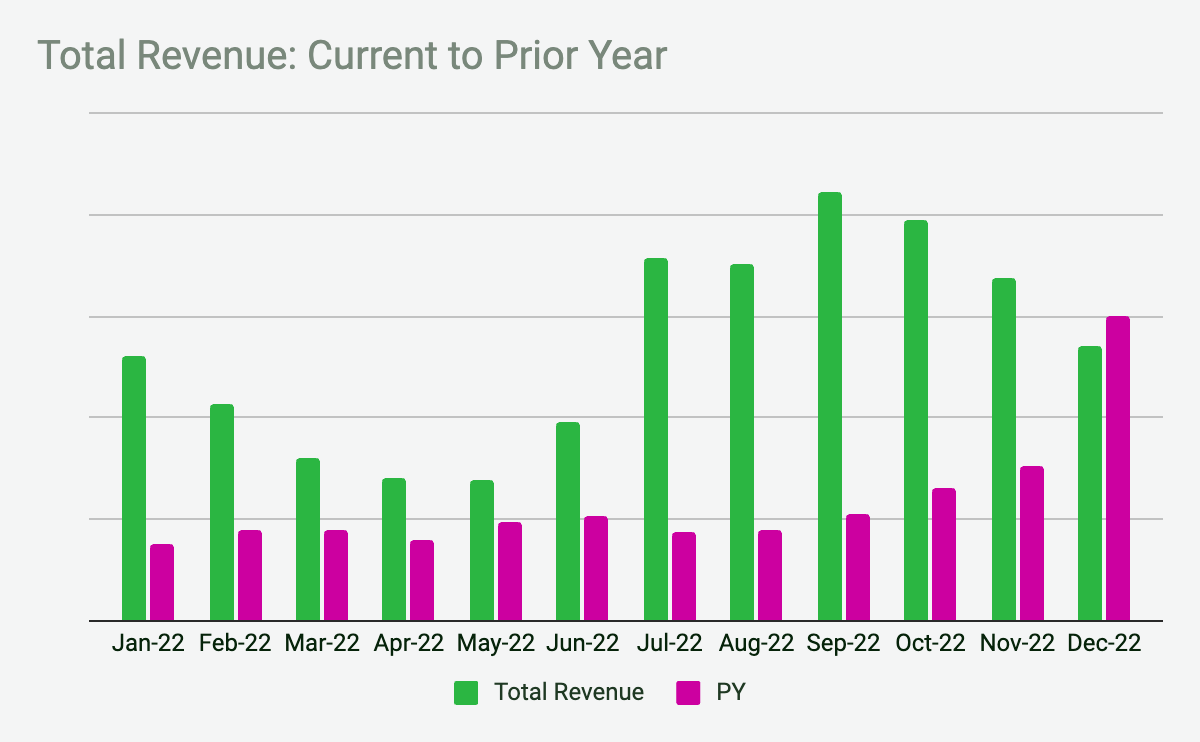

On the whole, performance last year was very strong – with the caveat that growth through much of the year was driven largely by traffic and programmatic ads and membership only got back on the growth path in late summer. Revenue as a whole more than doubled (up 133%) and operating profit before user acquisition and employee profit sharing increased almost 13𐄂.

Daily Dot

Traffic at Daily Dot was spectacular, making the title one of the fastest-growing news sites in the world. Averaging about 30 million users a month put Daily Dot in the upper echelons of tech and general interest news sites, alongside the Huffington Post, for example, though certainly a step behind the very first rank of the broadest, most famous news sites.

Traffic has been exceedingly well monetized — since mid-Q2 we have hit top RPMs for news sites. That’s been accelerated by progress breaking into premium programmatic, where we started the year with no business at all and ended the year with about mid-6 figures in revenue and lots of room for continued growth. In October premium was only about 7% of our inventory. The rates (CPM) on premium sales are 3 to 5 times what we receive in the open market, so it is a major growth opportunity.

One of our goals for Daily Dot, for several years now, has been to experiment with a member model on Daily Dot. The major progress this year on that front has been the progress on the newsletter. At the beginning of the year, the newsletter was, frankly, a bit of a mess. We now have a strong, dedicated editor who has built a solid core product with a highly engaged audience, which is something we can build on in 2023.

The top priority, to my mind, for Daily Dot is to start growing that newsletter aggressively while maintaining and further expanding its quality. More importantly, we are committed to continue experimenting with our business model to further align with our core purpose and values — we have, we think, the opportunity to use the largest news team in the world dedicated to internet culture to create something really cool that serves the extremely online community in new and unique ways.

Nautilus

In our first full year operating Nautilus (2020), we more than doubled volume. Last year, we were on track to do so again until October when the various privacy standards, largely driven by Apple, took effect. These decimated Facebook’s business overall, and seriously kneecapped our growth.

Late last year, and into the beginning of this one, we thought we had a clever alternative driven by aggressive newsletter growth… but we discovered by the end of Q1 that while the initial user engagement under that strategy looked good, readers were not staying engaged. We had some further stumbles as a result of internal, organizational issues. We cleaned up the mess from our failed experiment and have been reorganizing the team to drive essentially more and better marketing and promotions while improving the UX.

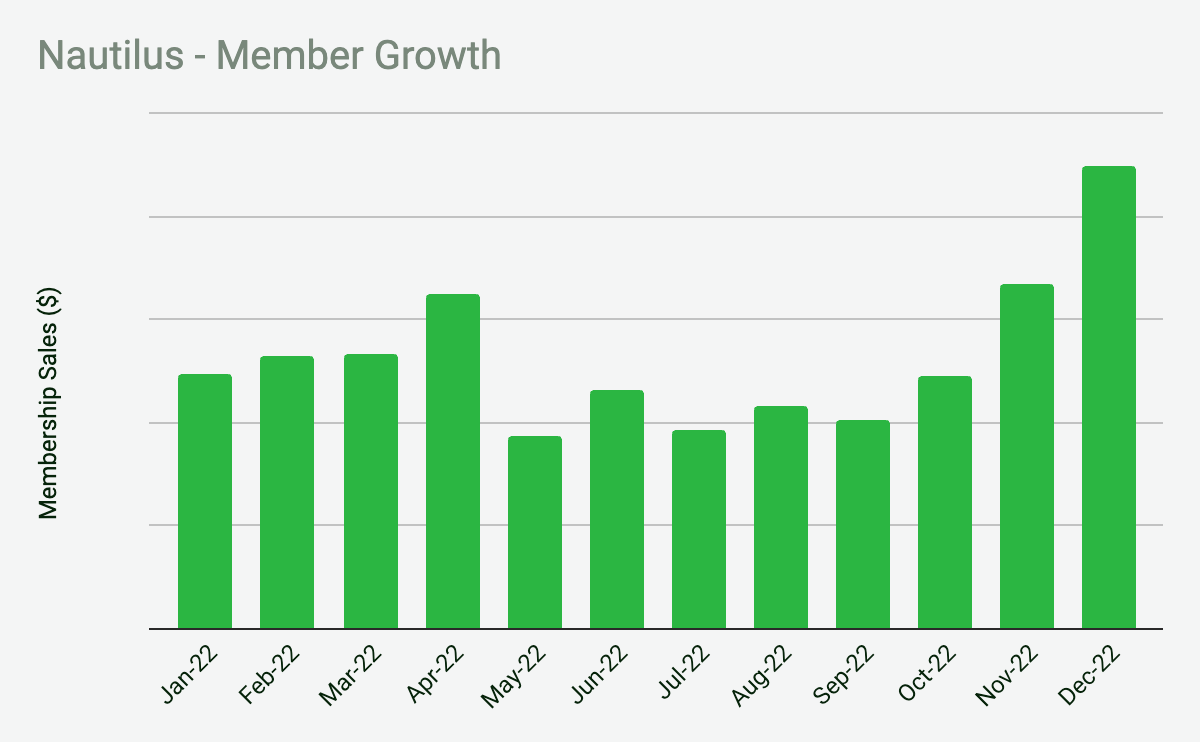

These efforts began to pay off in late Q3 and we have been growing total active membership every month since August and membership sales dollar volume ever since September. We closed the year up in dollar terms over any previous period — 135% over the year’s low point (May), 85% over January and 25% over our best month ever. From August to March, membership increased by about 10% overall.

Obviously, we need to maintain and expand that growth rate, which will result in the following:

- Expanding overall audience reach. To that end, we have added editorial staff to increase content and propose to increase the social team as well as the lead gen budget.

- Doing more promotions across more channels, which means increasing the acquisition budget to pull in larger numbers and our marketing staff to hit a consistent cadence.

- Improving the user experience – our analysis shows 70% of our new members are coming through a site visit, rather than responding directly to a promotion. We now have Nautilus mostly integrated into the FreePress platform and can start making significant improvements immediately.

I’ll have more to add to my quarterly report, but while we’re still early in these efforts, we’re seeing very positive near-term results.

While of course there are many things to work on and improve, we ended the year on a very high note and feel more bullish than ever about our strategy and direction.